How do I step by step on how to become rich legally? - Quora Things To Know Before You Buy

What Does 10 Ways To create real wealth Mean?

Do you desire to find out how to develop wealth? Naturally you do. Everybody enjoys the idea of being rich as much as they like a fairy tale ending. The two characters destined to end up together stroll off hand in hand into the sundown after vanquishing some villain or getting rid of some harrowing trouble.

To reach this ending, usually the hero has some distinct quality, has an edge others simply do not have, or deals with situations which supply the opportunity to seize the day. But what if someone who has none of these advantages could also increase above? Or much better yet, what if this individual found a way to walk this course while ignoring the stress suffered by the stereotyped hero? Let's explore how a normal person can be the hero of his or her own monetary future by building wealth through the amazing intensifying maker called the stock exchange.

Virtual Wealth Through Real Estate Event January 22-24, 2021

Some Known Details About How Much Can I Make Passively Investing in Syndications?

These heroes do exist, but make no error that a normal investor does not require to have any of these in fantastic supply to be effective when discovering and realizing his/her own monetary success. The most trustworthy approach to growing wealth is utilizing the last real edge in investing: time spent in quality financial investments.

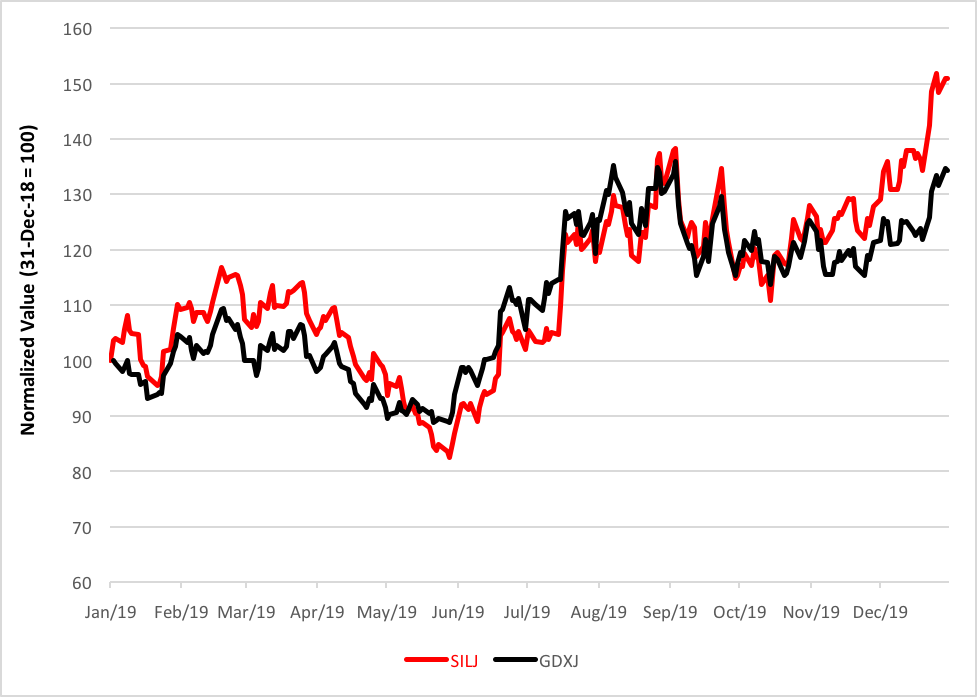

To see proof, look no more than Warren Buffett, the investing paragon commonly acknowledged as the very best investor in contemporary history. Source: He counts on intensifying for developing wealth every year. Preferably, his investment horizon is permanently. That takes conviction to stick with a financial investment that long. While he is not constantly precise with his stock choices, he carefully combines the force of intensifying with 3 major investing requirements: Discovering an exceptional company that can contend with time; Paying just a reasonable (or marked down) price for the investment; and Employing just quality managers who deliver sustainable, industry-leading returns.

How to Build Better Wealth with Caleb Guilliams

7 Easy Facts About How To Build Generational Wealth - Clever Girl Finance Explained

Generally where folks go incorrect is that 2nd criterion, or not having patience for an investment to perform with time. Remaining in a financial investment requires true conviction, specifically when the going gets rough. However, if I Found This Interesting held stock in a company which meets all 3 of Buffett's investing requirements and she or he did not require the cash, why should there be a sale? In reality, if there isn't a need for the money and the 3 requirements are still fulfilled, holding the investment is a much wiser decision.